Business Insurance in and around Council Bluffs

Looking for small business insurance coverage?

No funny business here

This Coverage Is Worth It.

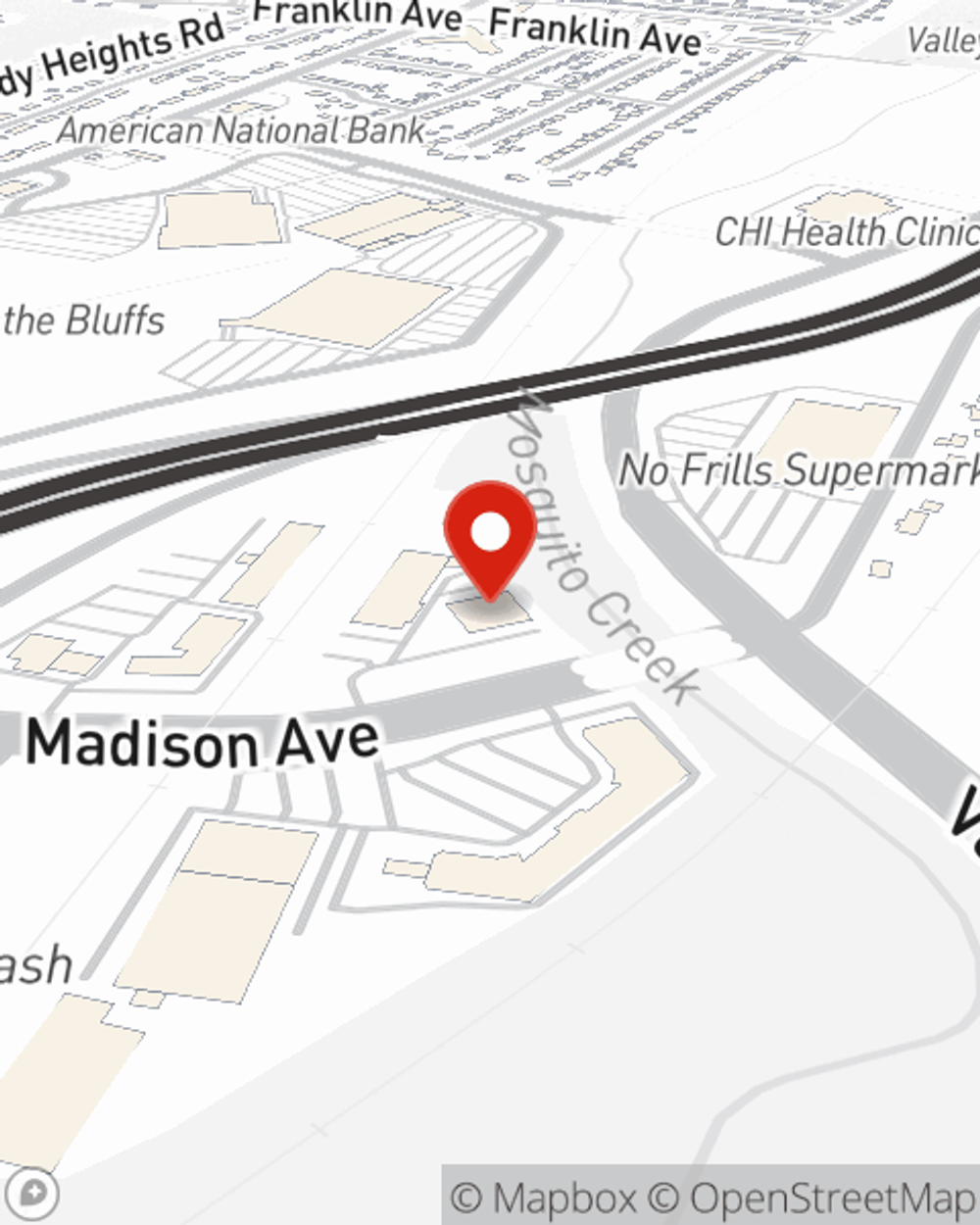

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Judd Knispel help you learn about your business insurance.

Looking for small business insurance coverage?

No funny business here

Cover Your Business Assets

Whether you are an acupuncturist a hair stylist, or you own a candy store, State Farm may cover you. After all, we've been doing it for almost 100 years! State Farm agent Judd Knispel can help you discover coverage that's right for you and your business. Your business policy can cover things such as buildings you own and money.

When you get a policy through one of the leading providers of small business insurance, your small business will thank you. Reach out to State Farm agent Judd Knispel's team today to explore the options that may be right for you.

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Judd Knispel

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.